Understanding Market Bubbles: The Psychology, Risks, and Insights You Need to Know

Why Market Bubbles Form, How They Grow, and What History Teaches Us About Avoiding Them

Imagine watching a balloon inflate. At first, it grows steadily, but the bigger it gets, the more fragile it becomes—until it suddenly bursts. Financial markets often follow the same pattern. These bursts, known as market bubbles, can devastate economies and wipe out personal fortunes. But why do these bubbles form in the first place? The answer lies not just in economic data but in something much more unpredictable—human psychology.

In this deep dive, we’ll explore how emotions drive market bubbles, the hidden risks lurking beneath today’s stock market giants, and how history, mental models, and psychology can help us spot and survive the next bubble.

Ready to uncover the forces inflating financial bubbles and how to protect yourself? Let’s begin.

The Psychological Triggers Behind Market Bubbles

Financial markets might seem like cold, rational systems driven by numbers and data. But if you look closer, you’ll find something far more volatile—human emotions. Fear, greed, and the instinct to follow the crowd are powerful forces that have fueled every major market bubble in history.

Irrational Exuberance and Fear of Missing Out (FOMO)

When markets are booming, it’s easy to believe that prices will keep rising forever. This belief, often called irrational exuberance, pushes investors to buy assets without fully understanding their value. Pair this with FOMO—the fear of missing out—and you have a dangerous cocktail. People start thinking, “If I don’t buy now, I’ll miss my chance to get rich.”

This exact mindset was rampant during the dot-com bubble of the late 1990s. Investors poured money into internet startups, many of which had no revenue, just because others were doing the same. The logic? “Everyone else is making money. Why shouldn’t I?”

The Role of the “Magnificent Seven” in Today’s Market

Fast forward to today, and a new form of concentration is brewing. Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta, and Tesla—the so-called “Magnificent Seven”—now make up 32–33% of the S&P 500, a share that’s double what it was just five years ago. This is even more concentrated than the market during the tech bubble of 2000.

Think about that. If these seven companies falter, the ripple effect could drag down the entire market. The U.S. stock market now represents over 70% of the MSCI World Index, the highest level since 1970. The global economy has never been more dependent on American tech giants, making the stakes incredibly high.

The “Lottery Ticket” Mentality

During speculative booms, many investors start treating stocks like lottery tickets. The thinking goes: “Sure, it’s risky, but what if it pays off?” This mentality encourages people to throw money into risky assets, hoping for a massive payoff. It’s the same psychology that drives people to gamble.

Remember Bitcoin’s 465% growth over two years? This explosive rise wasn’t based on traditional metrics like earnings or revenue but pure speculation. While some early investors got rich, many others bought in at the peak and suffered huge losses when the price corrected.

Passive Investing: Fueling the Fire?

Ironically, index funds—which are supposed to offer safety through diversification—may actually be inflating market bubbles. These funds automatically invest in the most valuable companies. As more money flows in, they buy more of these same stocks, driving prices even higher, regardless of the companies’ actual performance.

This creates a feedback loop where rising stock prices attract more investment, which pushes prices up even further. Stock prices start to drift away from the true value of the companies behind them.

High P/E Ratios: A Warning Sign?

Price-to-Earnings (P/E) ratios give us a sense of how expensive a stock is compared to the company’s profits. Historically, when the S&P 500 trades at a high P/E ratio—like today’s 22—long-term returns tend to be weak.

Take Nvidia, for example. Its P/E ratio in the low 30s suggests investors expect decades of growth. But what happens if Nvidia doesn’t deliver on these sky-high expectations? History tells us that when price growth outpaces earnings for too long, the market corrects sharply.

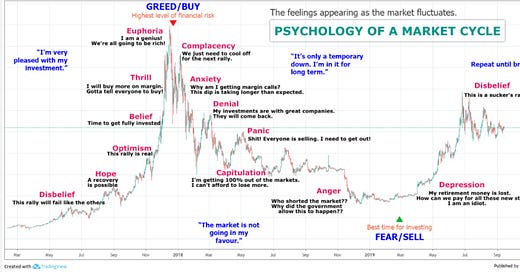

The Three Stages of a Bubble

Every bubble seems to follow a similar script, often described as the Three Stages of a Bull Market:

1. Skepticism: After a downturn, investors are cautious.

2. Acceptance: Confidence grows as prices steadily climb.

3. Euphoria: Investors believe prices will rise forever. This is when the market is most vulnerable.

By the time we reach the third stage, the risk of a crash is at its highest. Unfortunately, many investors only realize this when it’s too late.

Historical Lessons and Mental Models to Spot the Next Bubble

If markets are driven by psychology, then understanding human behavior is key to avoiding the next financial disaster. History doesn’t repeat itself, but it often rhymes. Let’s explore some mental models and historical lessons that can help us recognize the signs of a bubble before it bursts.

Reflexivity: When Beliefs Shape Reality

George Soros introduced the concept of Reflexivity, where investor beliefs can actually influence market outcomes. If enough people believe that a stock will rise, their collective buying drives the price up, turning that belief into reality. But this feedback loop eventually breaks when reality catches up, leading to sudden corrections.

The Greater Fool Theory

Ever heard of the Greater Fool Theory? It’s the belief that no matter how overpriced an asset is, there will always be someone (the “greater fool”) willing to pay more. This theory fuels bubbles until there are no more fools left, and prices crash.

This was evident in the housing market bubble of 2006, where even people with little financial knowledge bought multiple properties, assuming they could always sell at a profit.

Mean Reversion: What Goes Up Must Come Down

Mean Reversion suggests that prices eventually return to their historical averages. If stocks soar far above their average growth rate, they’re likely to come back down. This principle is often ignored in booming markets, leading investors to hold onto overvalued assets for too long.

Anchoring Bias: The Danger of Speculation

When new industries emerge, there’s little historical data to evaluate their worth. Investors anchor to speculative metrics like user growth or media buzz rather than actual profits. This was rampant during the dot-com bubble, where companies were valued on website clicks rather than revenue.

Strategies to Avoid the Trap

So, how can investors avoid falling into the bubble trap? It starts with recognizing the warning signs:

• Watch for Market Concentration: Is the market overly reliant on a few companies?

• Analyze Investor Behavior: Are non-experts and first-time investors flooding in?

• Evaluate Valuations: Are stocks priced far beyond their earnings?

• Diversify Investments: Don’t put all your eggs in one basket.

As the saying goes, “It’s not what you buy, it’s what you pay that counts.” Even great companies can be terrible investments if bought at the wrong price.

Conclusion

Market bubbles are as much a product of human psychology as they are of economics. Emotions like greed, fear, and FOMO can drive markets to dangerous heights, only to bring them crashing down. The dominance of a few companies, the effects of passive investing, and the spread of speculative behavior are all signs that investors must watch closely.

By studying history, applying mental models, and staying grounded in fundamentals, investors can better navigate the treacherous waters of financial markets. While we can’t predict when the next bubble will burst, understanding why they form can help us avoid being caught when it does.

The market may not always be rational, but that doesn’t mean you can’t be.